One of the common asks I hear from customers is the need to handle revenue recognition differently for different phases of a project. An example of this is “Contoso Electronics is working on a NextGen EV Electronics Design and Prototype build project for one of its customers. This is a fixed price contract/project that has 3 distinct phases.

- Design phase that runs for 3 months. This phase is billed in 2 milestones and revenue needs to be recognized upon Design completion.

- Prototype build phase that runs for 9 months. This phase is billed in multiple milestones and revenue needs to be recognized on a monthly basis based on % of completion.

- Post prototype support for enhancements work for 1 year. This is a fixed fee billed upfront and revenue needs to be recognized monthly on a straight-line basis.

There is now a new feature Microsoft released in Dynamics 365 Project Operations Resource/Non-stocked deployment which allows you to accomplish this easily. Before this feature, we were needed to split these phases into 3 different projects, but that is no longer needed.

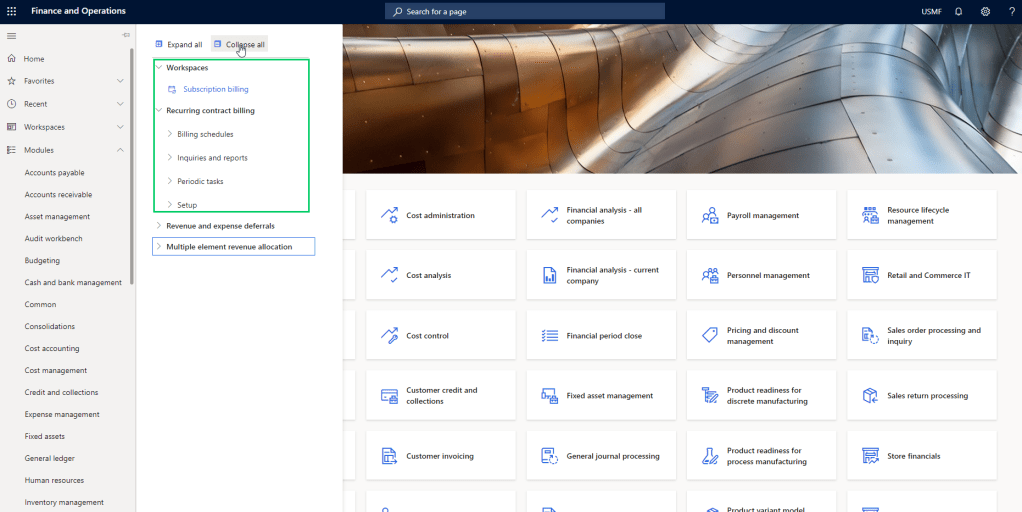

The new feature is called “Enable contract line-based revenue recognition with Project Operations for non-stocked/ resource-based scenarios” and this was released in preview last week.

When you enable this new feature, Project Operations will basically create a separate revenue estimate project for each contract line under the project contract. This allows you to setup one Project Contract that has multiple contract lines, where each contract line represents the work that will be done in each phase of the project. You can then associate separate cost and revenue profiles to each of the revenue estimate projects the system creates and handle the revenue recognition differently for each phase.

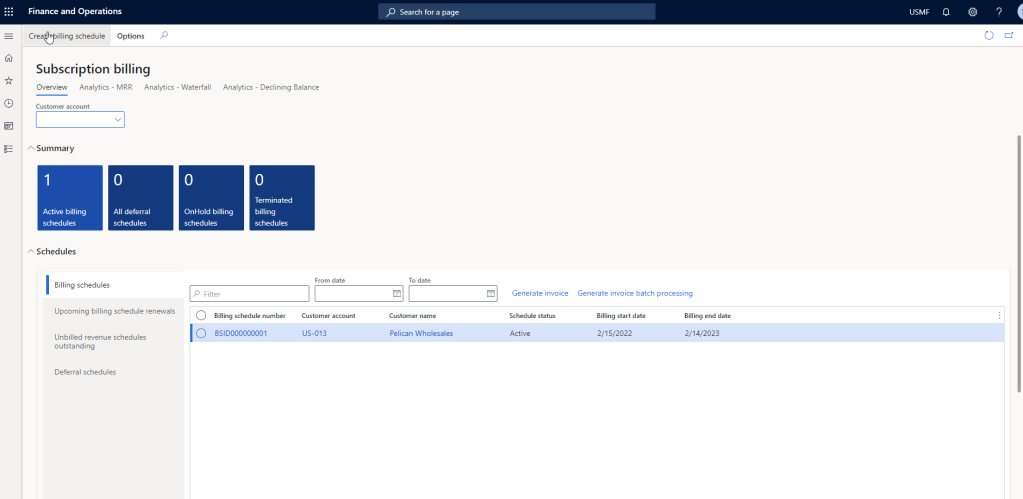

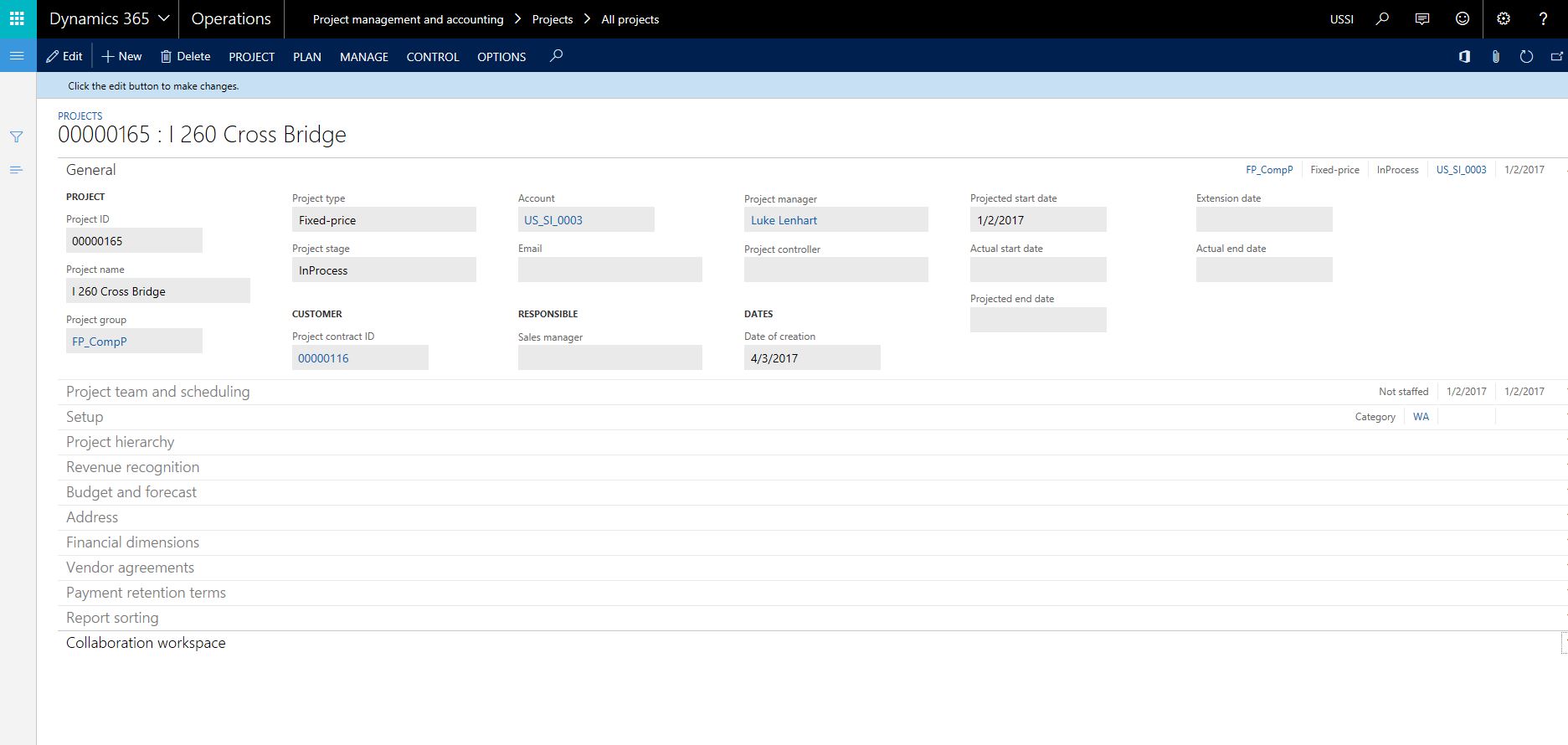

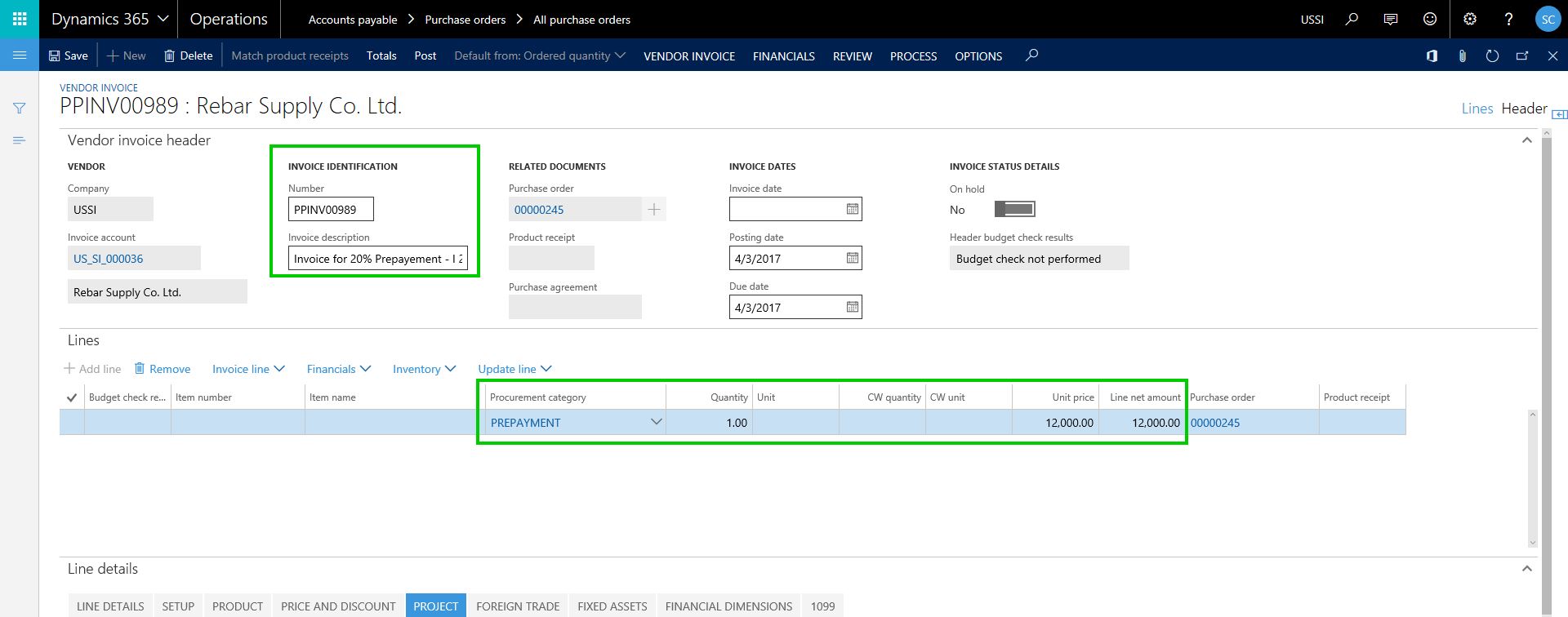

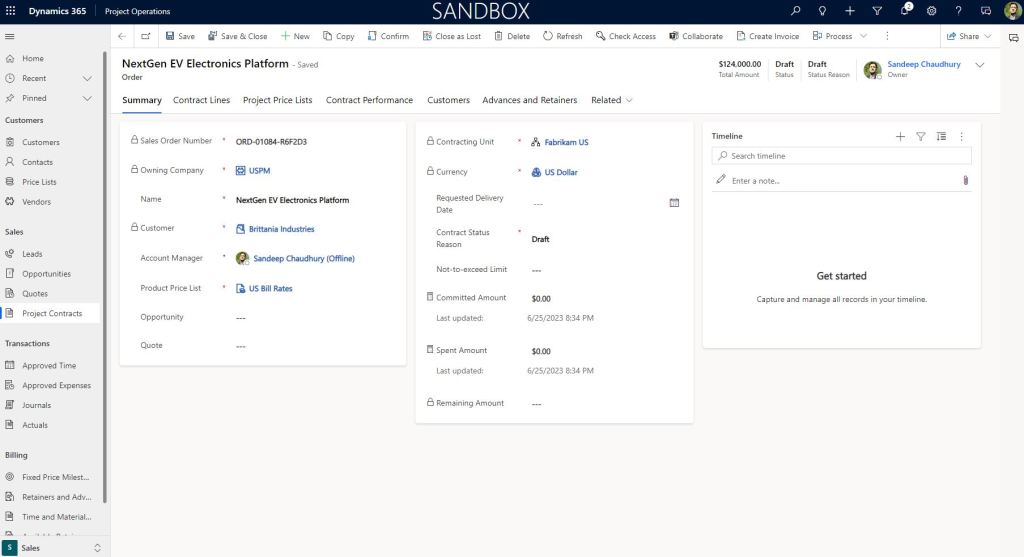

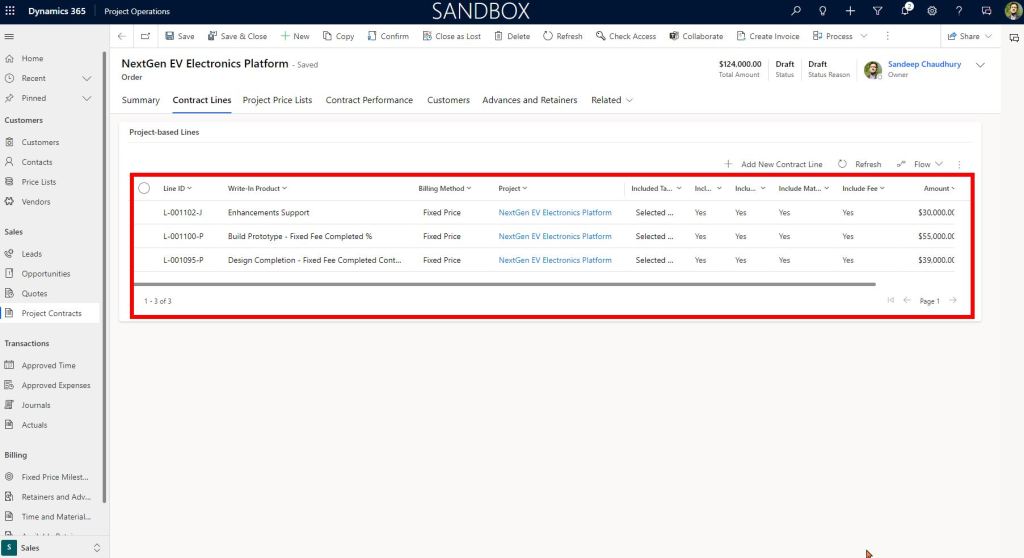

So, for the example scenario I provided above, I have setup a Project Contract that looks like below. Each of the contract lines/project phase have their own invoice schedule and associated contract amounts.

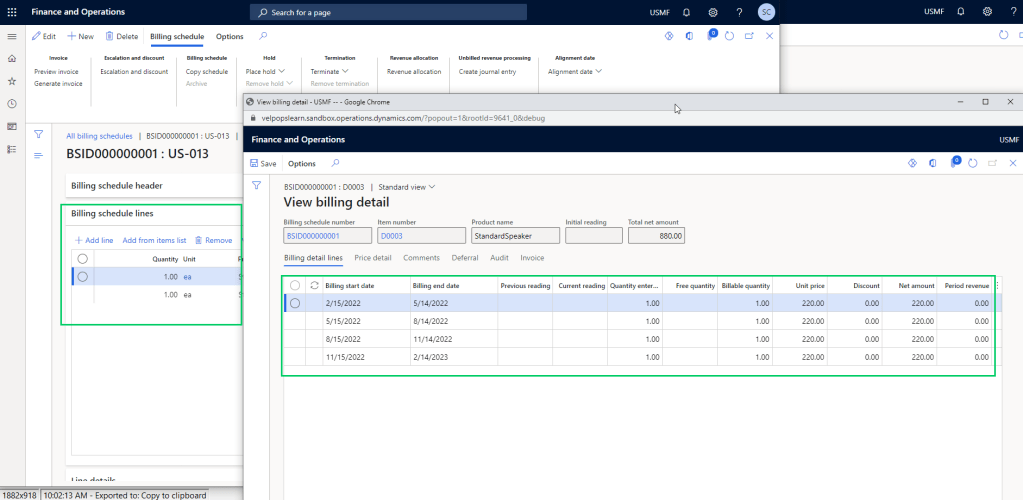

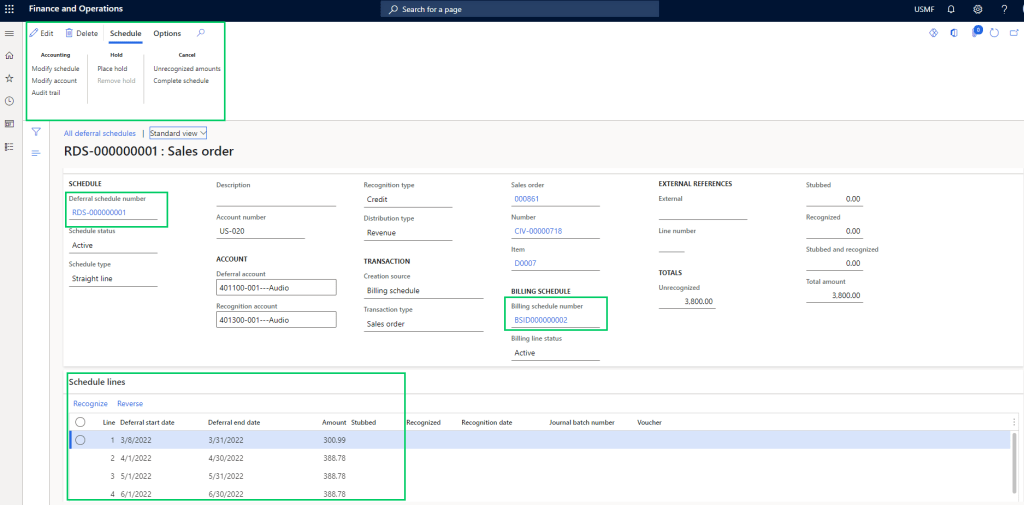

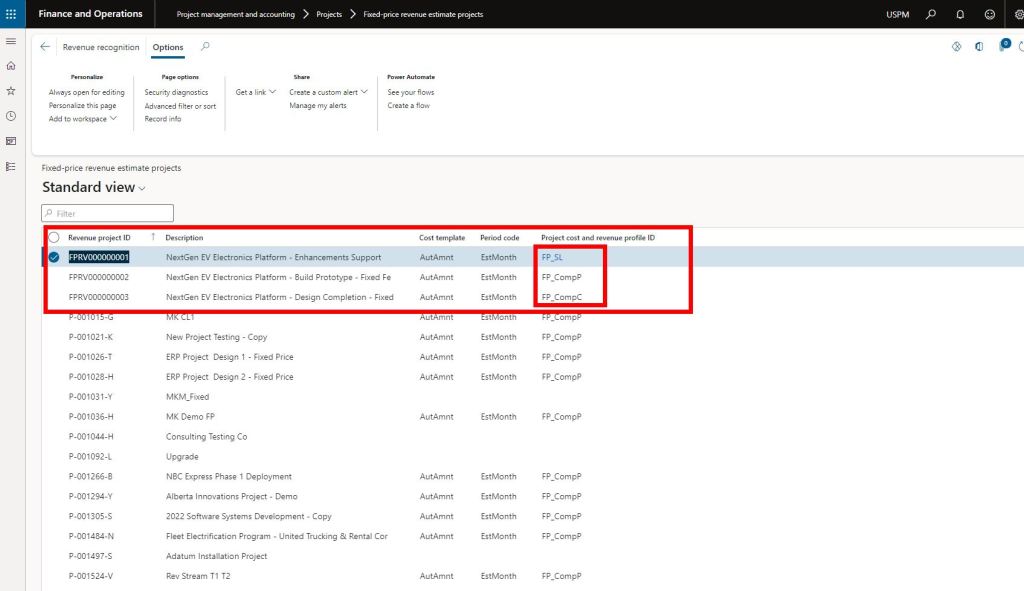

Screenshot below shows that system has automatically created 3 separate revenue estimate projects, one for each contract line. So basically, we now have a revenue estimate project setup automatically with their own contract amounts for each phase of the project, but the phases belong to one main project.

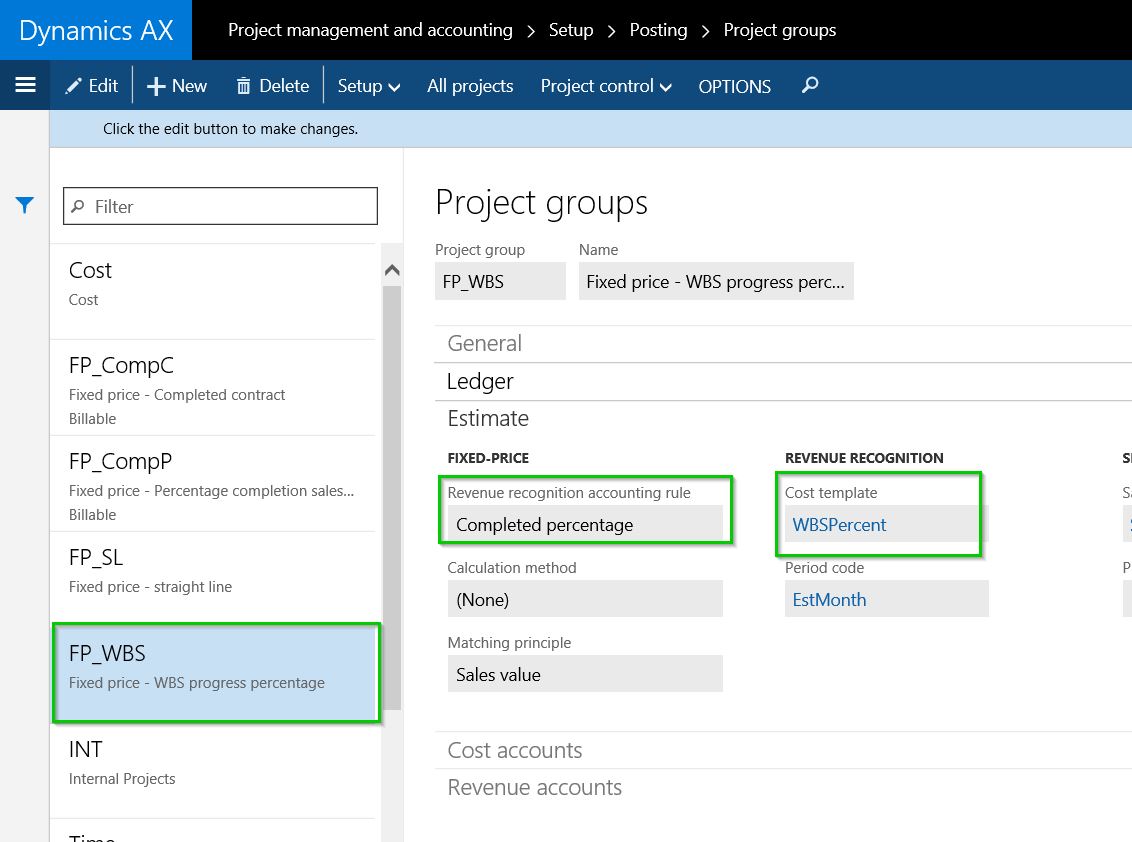

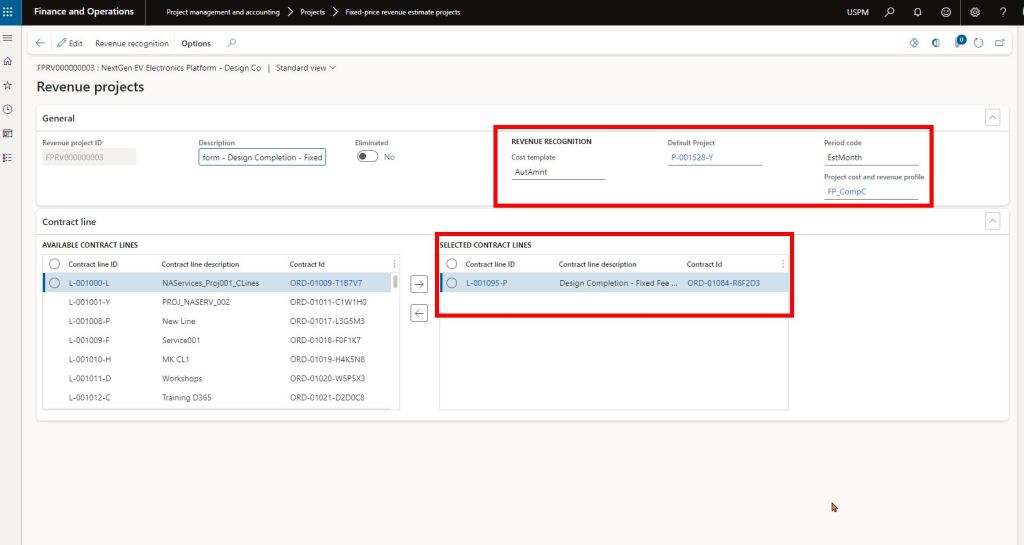

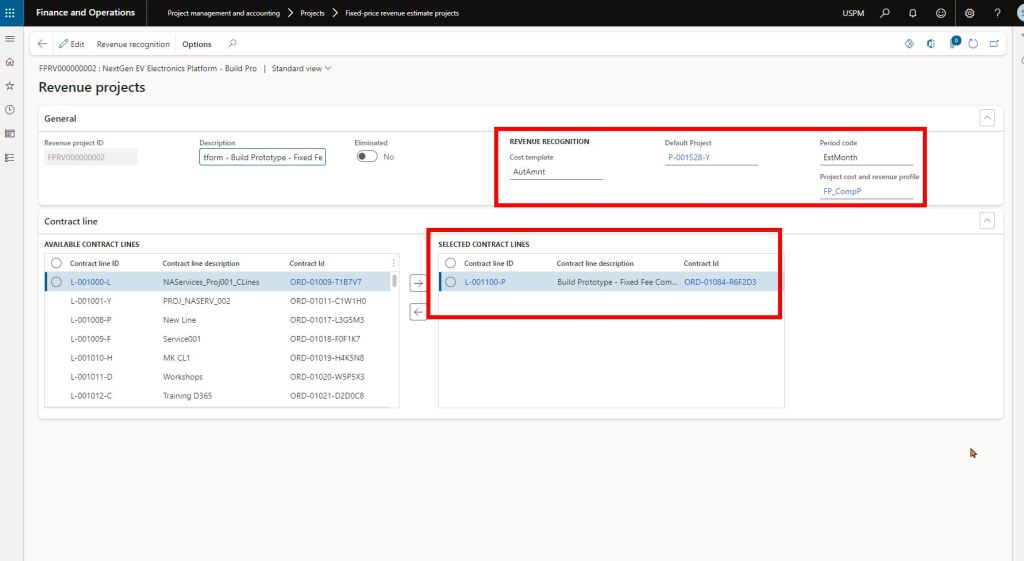

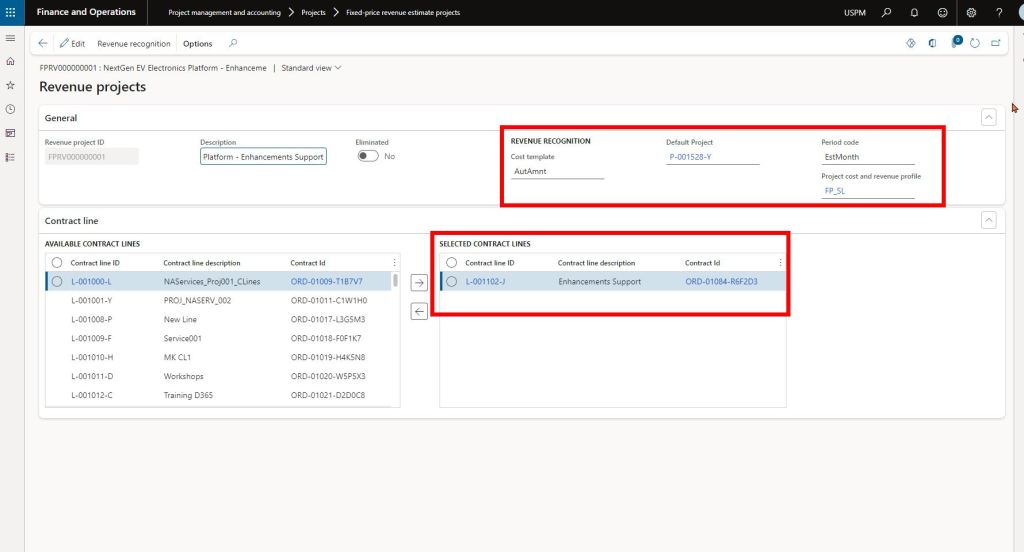

Also notice that each of these revenue estimate projects is associated with a different Project cost and revenue profile ID, which allows you to process revenue recognition using different rules for each phase of the project. You will need to select the default parent project for each of these revenue estimate projects.

The Design phase of the project has revenue estimate project that is associated with the corresponding contract line and is setup with a Completed Contract revenue recognition principle.

The Prototype build phase of the project has revenue estimate project that is associated with the corresponding contract line and is setup with a Completed % based revenue recognition principle.

The Enhancement Support phase of the project has revenue estimate project that is associated with the corresponding contract line and is setup with a Stright line revenue recognition principle.

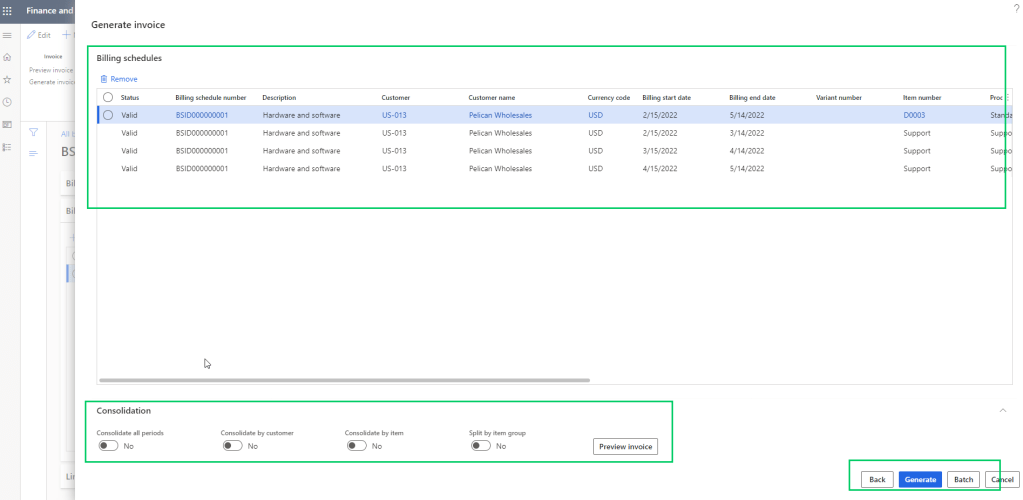

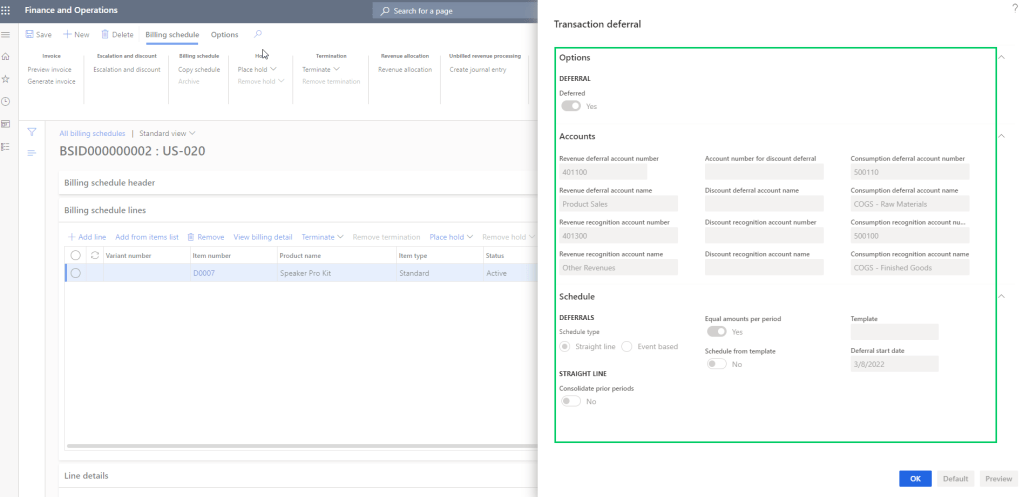

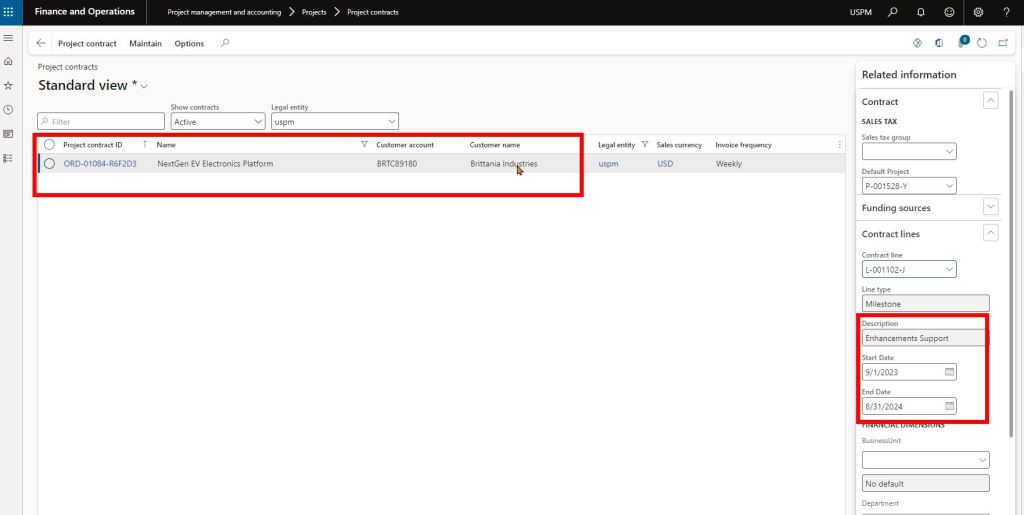

For the contract line that needs to follow straight line revenue recognition principle, you will additionally need to setup the start and end dates of the revenue recognition under the contract line in the project contract default accounting setup. See screenshot below.

That’s it. From here on, when you run the job for revenue recognition, system will automatically calculate revenue recognition amounts based on the associated contract amounts for the contract lines and the cost and revenue profile setup.